Table of Contents

ToggleIt’s a moment of relief — you’ve just received your first education loan offer. After weeks of researching universities, preparing for entrance exams, and navigating application deadlines, seeing that approval feels like a green light to move forward. But before you sign on the dotted line, take a step back. Accepting the first loan offer without doing a proper student loan comparison could quietly add a massive financial burden to your future.

Take Rishika’s story, for example. She rushed to accept the first loan offer she got because she was eager to secure funding and focus on her dream of studying in Canada. A year later, she discovered she was paying nearly 3% more in interest compared to some of her classmates, adding up to several lakhs in extra repayment. If only she had explored her options, she could have saved herself a lot of stress — and money.

The truth is, not all loans are created equal. Interest rates, repayment terms, and additional perks vary widely between lenders, and rushing into the first offer could mean paying thousands more in the long run. Let’s break down why comparing student loan options is crucial and how making the right choice can set you up for financial success — both during your studies and after graduation.

Why Accepting the First Loan Offer is Risky

It’s understandable — the process of applying for loans feels overwhelming, and the first approval seems like a lifeline. But accepting it without a second glance can lock you into unfavourable terms. Student loans aren’t just about getting money in your account; they shape your financial future for years to come.

For example, a slight difference in interest rates can result in paying back significantly more. According to a study, even a 1% difference in interest rates on a ₹40 lakh loan can lead to over ₹4 lakh in additional payments over a 10-year term. Add to that hidden fees, rigid repayment schedules, and a lack of flexibility in case you need breathing room, and you could find yourself in a financial bind before you’ve even boarded your flight.

Student Loan Comparison: Your Key to Better Options

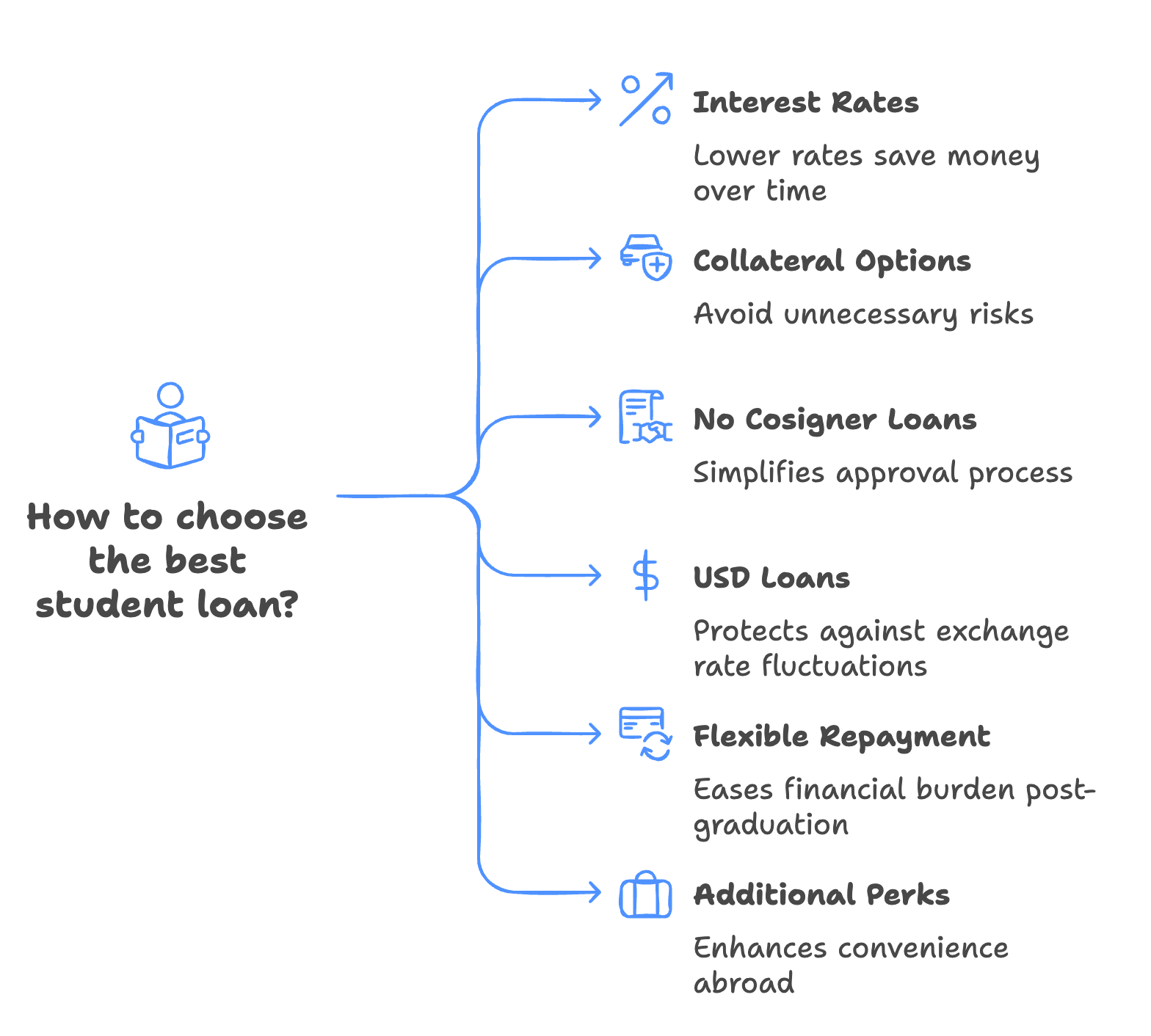

When you compare loans, you’re not just looking at numbers — you’re making an informed decision that impacts your future. Here’s what you should be considering:

- Interest Rates: Even a 0.5% difference can save you a lot over time. Lorien Finance, for instance, offers rates starting at just 3.39%.

- Collateral vs. No Collateral Options: Depending on your profile, you might not even need to pledge collateral — so why take on unnecessary risks?

- No Cosigner Loans: Some lenders offer no cosigner loans, meaning you don’t need a guarantor to secure funding.

- USD Loans: Planning to study in the US? Opting for a USD loan could save you from exchange rate fluctuations.

- Flexible Repayment: Look for loans that offer grace periods after graduation or options to pay only interest while you study.

- Additional Perks: Some lenders offer ancillary services like opening a US bank account and issuing a debit card before you arrive, making life abroad that much smoother.

The True Cost of Not Comparing Student Loans

By not conducting a proper student loan comparison, you risk ending up with:

- Higher Interest Rates: Which directly impacts how much you pay back.

- Strict Repayment Terms: Less flexibility means more stress if you hit a rough patch.

- Missed Perks: Like rate discounts for timely payments or access to financial tools that simplify international transactions.

Think of it this way: would you buy the first flight ticket you find without checking prices on other websites? Probably not. So why treat something as crucial as your education loan any differently?

How Lorien Finance Simplifies Student Loan Comparison

This is where Lorien Finance steps in. As India’s smartest study abroad loans marketplace, we don’t just hand you one option and call it a day. We help you explore multiple lenders, compare interest rates, and find the best fit for your unique needs. Whether you’re looking for no-cosigner loans, USD loans, or 100% funding with no collateral, we’ve got you covered.

Plus, Lorien Finance offers transparent guidance through every step, ensuring you understand all terms and conditions before making any commitments. It’s about giving you the power to make informed decisions with confidence.

Don’t Miss Lorien’s Study Abroad Loan Fest

We know financing your education can feel overwhelming, so we created Lorien’s Study Abroad Loan Fest to make things easier. This event, also India’s biggest Study Abroad Loan Fest is designed to give you a head start in securing the best education loan with personalised assistance, faster approvals, and access to incredible benefits. During the Loan Fest, students get:

- One-on-one sessions with experts to help navigate the loan process.

- Access to multiple lenders to find the most competitive rates.

- Expedited processing to get your loan sanctioned quickly.

- Special rewards like an iPhone 16, Macbook Air, Study Abroad Travel Kits worth Rs. 20,000 only available during the event.

Whether you’re still weighing your options or need that final push, the Study Abroad Loan Fest ensures you’re not settling for less when funding your dreams.

Your study abroad journey is one of the biggest adventures of your life, and the loan you choose plays a major role in shaping that experience. Take a breath, do a proper student loan comparison, and make a choice that supports your future, not just your present. Lorien Finance is here to help every step of the way.

FAQs

Why shouldn’t I accept the first loan offer I get?

The first offer might not have the best interest rates or repayment terms. Comparing options ensures you get a loan that fits your financial needs.

What makes Lorien Finance different?

Lorien Finance is a marketplace that helps you compare multiple lenders, offering no-cosigner loans, USD loans, and flexible repayment options.

How does Lorien’s Study Abroad Loan Fest help me?

The Loan Fest offers exclusive benefits like personalised guidance, faster loan approvals, and access to special rate discounts.

What happens if I’m not sure what kind of loan suits me best?

No worries — Lorien Finance’s expert counsellors guide you through comparing student loans and finding the one that aligns best with your goals.