Table of Contents

ToggleImagine this: You’ve got your acceptance letter, your dream university awaits, and the excitement is through the roof. But then reality hits—how will you finance your education abroad? You start looking at loans, and suddenly, you’re bombarded with numbers, interest rates, hidden charges, and fancy banking terms like APR. It feels overwhelming, right? Whether your fuding is through USD vs INR loans, learn why APR matters!

Well, take a deep breath—we’ve got your back.

One of the biggest mistakes students make is focusing only on the interest rate while choosing a

loan. But what if we told you that’s only half the story? The real game-changer is APR (Annual

Percentage Rate)—the actual cost of borrowing, including fees and other charges. This one

number can make or break your loan decision, and today, we’re breaking it down for you.

So, grab a cup of chai , and let’s simplify USD vs. INR Loans and why APR is the secret sauce to

making the smartest financial choice for your study abroad dreams!

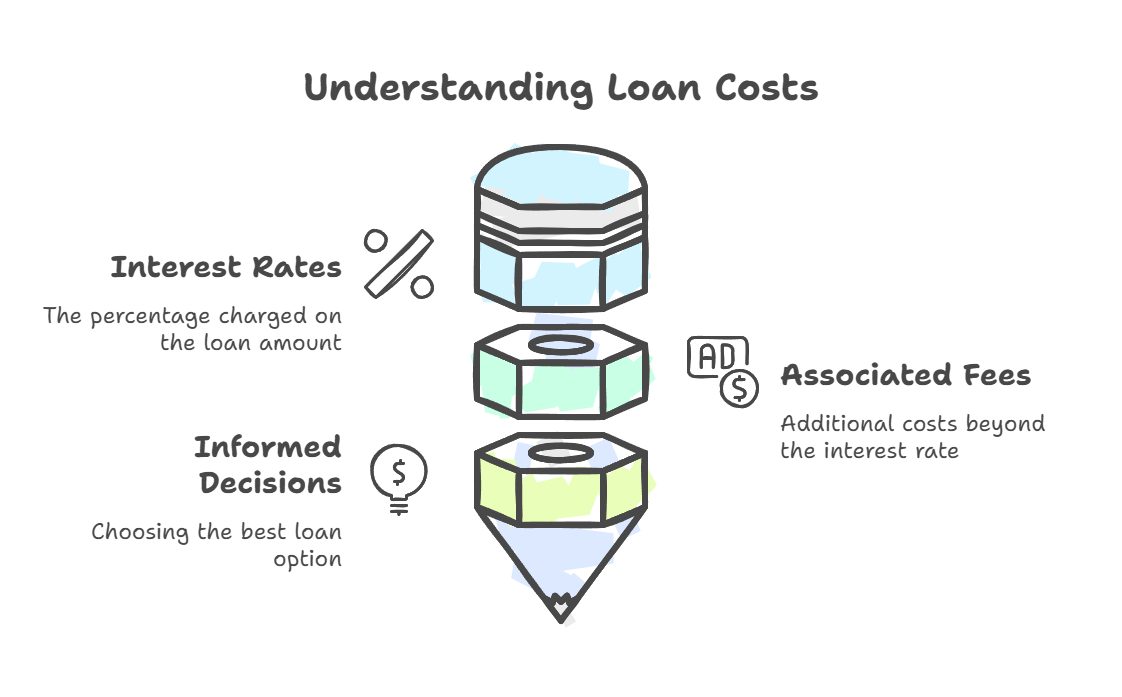

Understanding APR: Your Loan’s True Cost, No Hidden Surprises

APR isn’t just another boring financial term—it’s your best friend when comparing loans.

Think of it as the MRP (Maximum Retail Price) of a loan. Just like you wouldn’t buy a gadget

without knowing the total cost (including taxes and delivery), you shouldn’t take a loan without

considering its APR.

Here’s why:

- While banks and lenders advertise interest rates, they often hide extra costs like processing fees, insurance, and other charges.

- APR factors in all these additional costs, giving you the real picture of how much your loan will

cost you annually. - A loan with a low-interest rate but high fees might be more expensive than a loan with a higher interest rate but low fees—APR helps you compare them fairly.

USD Loans vs. INR Loans: The Ultimate Face-Off

When you’re funding your education abroad, you typically have two options:

- USD Loans – Offered by international lenders and disbursed in US Dollars.

- INR Loans – Provided by Indian banks and disbursed in Indian Rupees.

Each has its pros and cons, and the APR of each loan type will vary based on multiple factors. Let’s

break it down:

Interest Rates: Who Wins?

- USD Loans: Lower interest rates (5% to 10%)

- INR Loans: Higher interest rates (10% to 14%)

Why? International lenders have access to cheaper capital, whereas Indian lenders face higher

borrowing costs.

Collateral: Do You Need to Pledge Assets?

- USD Loans: Often no collateral require

- INR Loans: Collateral usually required (property, FDs, etc.)

Why? USD lenders cater to students who might not have strong financial backing, while Indian

banks demand security.

Co-Signer: Who Has Your Back?

- USD Loans: May need a U.S. co-signer (a sponsor living in the U.S.)

- INR Loans: Indian co-signer (typically a parent/guardian)

Why? Foreign lenders want an assurance of repayment from someone in their country.

Why APR is the Real Deal in Loan Comparison

APR is your financial reality check. A loan with a low-interest rate but high fees can be more

expensive in the long run. APR helps you compare loans apples to apples, so you don’t fall for

marketing gimmicks.

Example:

- Loan A: 8% interest rate, but with a 5% processing fee → Effective APR = 10%

- Loan B: 10% interest rate, with only 1% processing fee → Effective APR = 10.5%

At first glance, Loan A seems cheaper, but after adding hidden costs, Loan B is almost the same!

Currency Fluctuations: The Wild Card

Here’s something most students don’t think about: If you take a USD loan, you’ll repay in USD.

Sounds obvious, right? But here’s the catch:

- If INR depreciates against USD, your repayment amount in INR increases.

- If INR strengthens, you might pay less in INR terms.

What’s the risk? If the rupee falls from ₹87/USD to ₹95/USD, your EMI amount in INR goes up!

How Lorien Finance Can Make Your Loan Journey Smoother

We get it—choosing the right education loan is like playing a high-stakes game of chess. One

wrong move, and you could be paying lakhs extra!

That’s where Lorien Finance steps in:

- Personalised Loan Comparison – We help you compare USD vs. INR loans based on APR, hidden fees, and exchange rate risks.

- Lowest Interest Rates – We connect you with lenders offering the best loan deals for Indian

students. - End-to-End Assistance – From paperwork to approval, we’ve got you covered.

Your study abroad dream shouldn’t be delayed because of financial confusion. Let’s make it

happen, stress-free!

Choosing between a USD and INR loan isn’t just about interest rates. APR is your true cost of

borrowing, and ignoring it could cost you lakhs in the long run.

Want expert help with your education loan? Let Lorien Finance simplify your journey so you can

focus on what matters—your future!

Talk to our experts today & secure the best loan for your study abroad adventure!

FAQs

Are USD loans always better than INR loans?

Not always! USD loans have lower rates but come with currency risks. INR loans provide stability,

but at a higher cost.

Will my INR loan cover all my expenses abroad?

Indian banks may not cover 100% of expenses (like living costs). You might need a mix of INR and

USD loans.

Can I switch from a USD loan to an INR loan later?

Some lenders offer refinancing options, but not all loans are convertible. Check with your lender

before taking the plunge.

How do I find the best loan for me?

That’s where Lorien Finance comes in! We help you compare, apply, and get the best loan tailored

to your needs.